Assessing the Permanence of Damage to the Dollar’s Status

With current global economic shifts, the U.S. dollar’s dominance is under scrutiny. This article delves into the potential permanent effects on its status, examining the underlying factors and economic indicators that could redefine its role in international trade and finance.

The Current State of the U.S. Dollar

The U.S. dollar has long held its position as the world’s primary reserve currency, providing stability and a standard for global transactions. However, recent economic challenges have raised questions about its continued dominance. Economic policy shifts and evolving international relations are impacting its strength and influence.

Factors Contributing to Potential Weakness

1. Global Economic Shifts: The rise of emerging markets and alternative currencies are leading to a more competitive global currency environment.

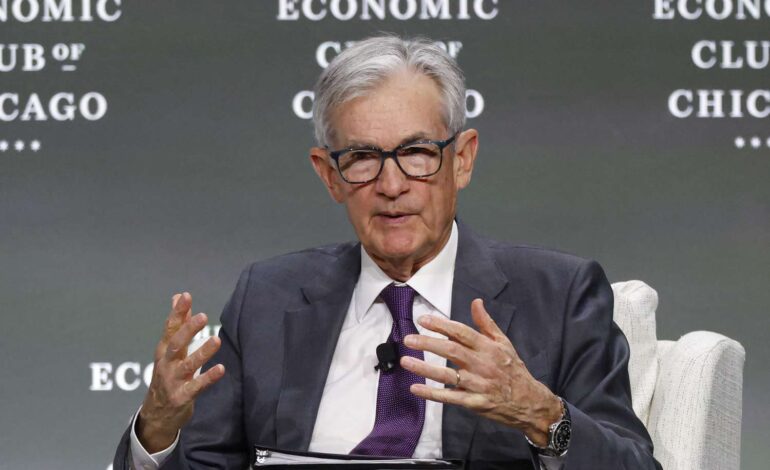

2. Monetary Policy: U.S. fiscal decisions, particularly regarding interest rates and inflation, play a significant role in shaping the dollar’s future.

Impact of International Relations

Geopolitical tensions and trade policies significantly affect the perception and utilization of the U.S. dollar. During turbulent times, countries may seek to diversify their reserves, impacting demand for the dollar.

Potential for Recovery and Strengthening

Despite the challenges, the U.S. dollar maintains certain advantages, such as deep financial markets and political stability. By reinforcing these strengths, and through adept policy-making, there lies a potential path for the dollar to retain and perhaps enhance its leading status.

Conclusão

While the U.S. dollar faces challenges due to global shifts and economic uncertainties, its foundational stability remains largely intact for now. Strategic actions by U.S. policymakers and economic adjustments will be crucial in maintaining its predominant position in the global financial landscape.