Bessent Critiques Moody’s: A Lagging Measure of US Fiscal Health

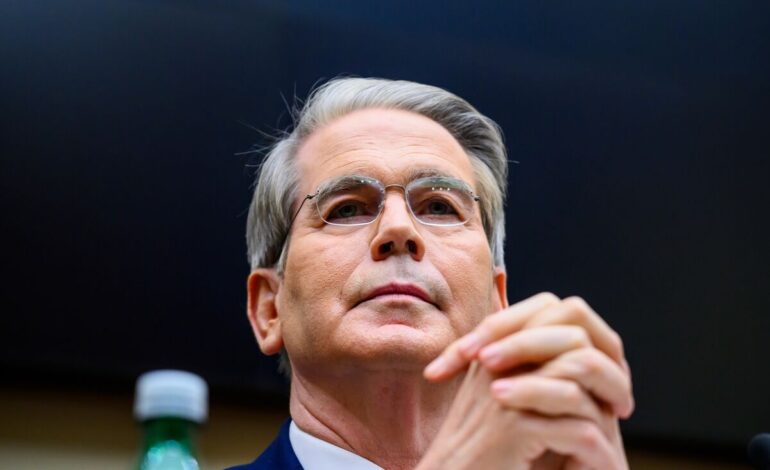

In a striking commentary, hedge fund billionaire Bessent has critiqued Moody’s for being a ‘lagging indicator’ of the United States’ economic health. This article explores the nuances behind this statement, analyzing the relevance of Moody’s ratings in reflecting the present fiscal conditions of the U.S.

Understanding Moody’s Role in Economic Ratings

Moody’s has long been a stalwart in financial analysis, offering credit ratings and assessments of economic conditions worldwide. *Its reports are influential*, affecting investor confidence and decision-making. But how does it maintain this role amidst evolving economic landscapes?

Bessent’s Criticism: A Deep Dive

Bessent, a notable figure in the financial sector, argues that *Moody’s often falls behind actual economic trends*. His view suggests that their ratings are more reflective of past data rather than predictive of future conditions. What are the implications of this for investors and policymakers?

Comparing Ratings: Moody’s vs. Real-time Indicators

While Moody’s ratings are based on extensive data analysis, real-time economic indicators provide a more immediate snapshot of fiscal health. How do these measurements stand against each other, and which is more reliable for gauging the U.S. economy’s current state?

The Impact on U.S. Fiscal Policy

If Moody’s ratings are indeed ‘lagging’, this might affect U.S. fiscal policy decisions that rely on these assessments. *Understanding the potential disconnect* between ratings and reality is crucial for formulating effective economic strategies.

Moving Forward: Addressing the Criticism

How can Moody’s, and similar institutions, adapt to provide more accurate, *real-time assessments*? This chapter explores potential advancements in financial analytics to respond to Bessent’s critique and enhance economic forecasting.

Conclusion

Bessent’s critique of Moody’s as a ‘lagging indicator’ highlights a significant challenge in the financial world. Accurate, timely economic assessments are crucial for informed decision-making. By addressing these critiques, Moody’s could strengthen its role in global economic analysis. Enhancing real-time data integration may pave the way for more future-proof fiscal evaluations.