Rising Risk Assets Following Robust Payroll Data in May 2025

In May 2025, financial markets responded to unexpectedly strong payroll data with a surge in risk assets. This article examines how this economic indicator influences market trends and investor behavior, providing insights into the dynamics of risk assets and the macroeconomic environment shaping

Understanding Mortgage Rates: Insights from May 2, 2025

On May 2, 2025, mortgage rates fell to 6.76% for 30-year loans, marking a significant interest shift. This article delves into the implications of this change, the factors influencing the mortgage market, and what potential homeowners and investors can expect moving forward. The

Global Stocks Surge Amid Renewed US-China Trade Negotiations

In the latest development on the global trade front, stock markets have experienced a significant rally as Beijing considers reopening trade talks with the United States. This potential diplomatic progress has sparked investor optimism across the globe, reflecting positively on stock indices and

Adani Ports Expands Horizons: South Africa Takes Center Stage

Adani Ports is set to expand its global footprint with a renewed focus on South Africa. This move marks a significant step in Adani’s global expansion strategy, aiming to enhance its operational presence and leverage emerging market opportunities. This article delves into Adani

Stock Markets Open Higher as U.S. Payroll Surpasses Expectations and China-U.S. Talks Show Progress

In the wake of encouraging U.S. payroll data and promising advancements in China-U.S. diplomatic talks, New York stock markets opened with gains. Investors are optimistic about these positive indicators, which suggest potential economic growth and improved international relations. This article dives into the

Shell Stock Soars on Robust Earnings and $3.5 Billion Buyback Initiative

Shell’s stock surged following the announcement of impressive quarterly earnings and a significant $3.5 billion buyback program. This article delves into the financial results and strategic plans that propelled Shell’s stock upward, while examining the broader implications for investors and the energy market.

Block’s Strategic Shift: Analyzing the Stock Dive Amid Economic Uncertainty

The recent downturn in Block’s stock, Cash App’s parent company, reflects a strategic shift towards cautiousness amid a challenging economy. This article delves into the factors contributing to the company’s decision, the broader economic implications, and the stock’s future prospects. Overview of Block’s

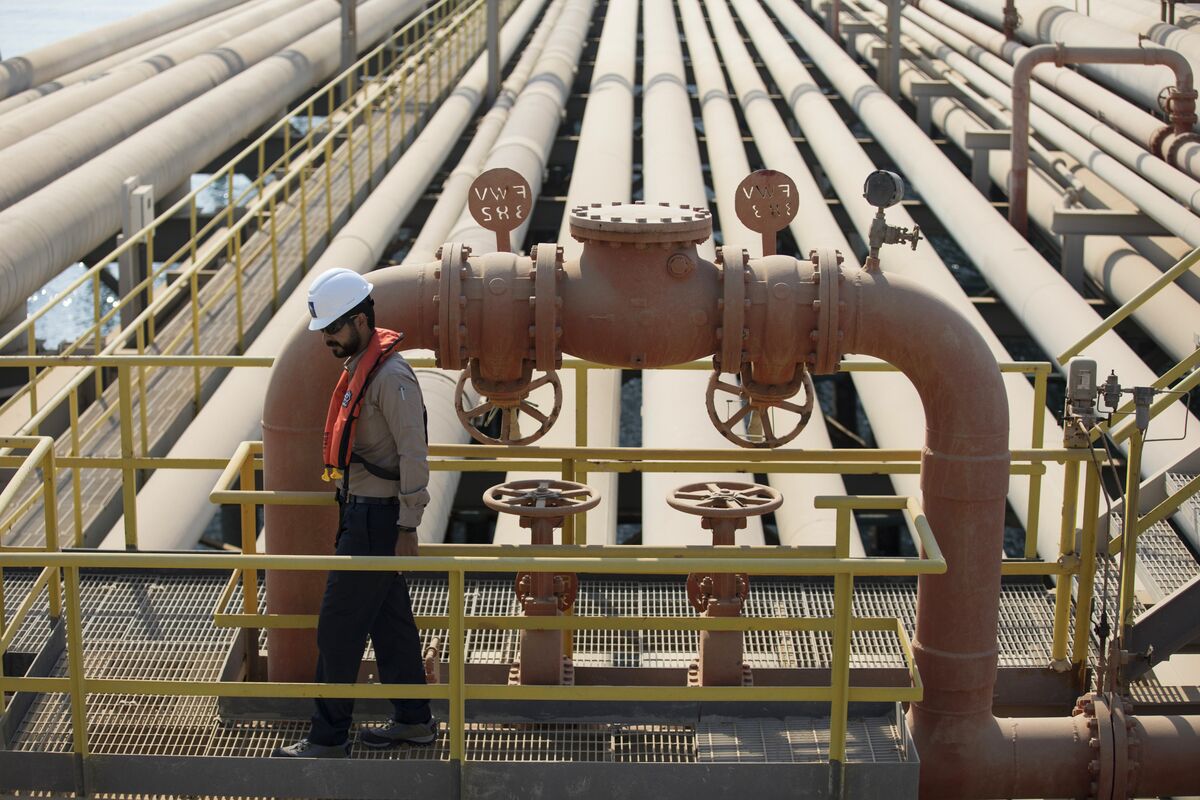

OPEC+ Advances Meeting to Deliberate on June Oil Output Plans: Insights and Implications

In a significant move, OPEC+ has decided to bring forward its meeting to discuss June’s oil output plans. Set for May 3, this decision underscores the bloc’s responsive approach to the ever-evolving global energy landscape. This article delves into the reasons behind this

Ibovespa Faces Stability Amidst Payroll Data and US-China Talks

This article delves into the current state of the Ibovespa as it hovers around stability, focusing on the impact of recent US payroll data and ongoing negotiations between China and the United States. These factors play a crucial role in shaping investor sentiment

Foreign Investment Boosts Brazilian Market with 1.1 Billion BRL Influx

On April 29, foreign investors injected 1.1 billion BRL into the Brazilian market, helping to reduce the month’s negative balance. This strategic move demonstrates renewed international interest in Brazil’s financial potential. This article explores the implications of this shift, examining the factors driving