Understanding the Implications of Trump’s Trade Threats on Global Markets

In recent times, investors around the globe are eagerly awaiting details on former President Donald Trump’s trade threats. These threats have significant implications for global markets, influencing economic decisions across nations. This article delves into the potential ramifications of these threats on international trade and the complex reactions of the investor community.

Impact of Trade Threats on Global Markets

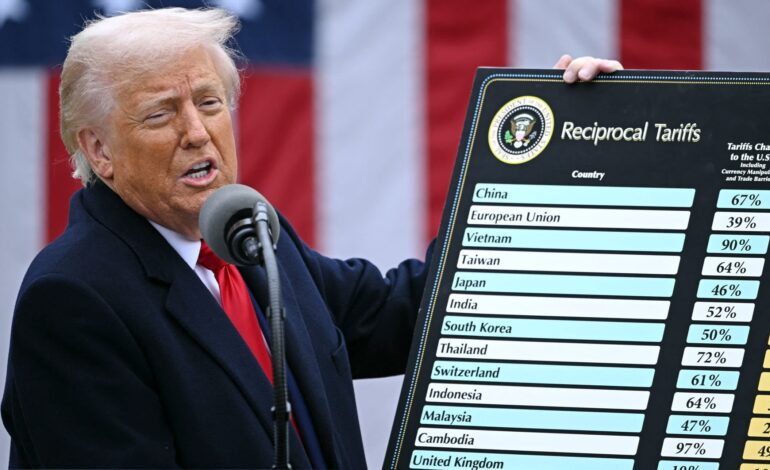

The recent **trade threats by Trump** have raised concerns about potential disruptions in global supply chains. These threats could lead to tariffs, impacting international trade agreements and altering market dynamics. *Investors are keenly observing these developments*, as any significant trade barriers could have far-reaching effects on global economic stability.

Investor Reactions and Strategies

Due to the current uncertainties, investors are **adopting cautious strategies**. Many are diversifying their portfolios to reduce risk exposure, while others are exploring emerging markets for new opportunities. The volatility induced by trade threats requires *careful analysis and strategic planning* to maintain favorable investment returns.

Economic Forecast and Policy Implications

Experts are predicting that ongoing trade tensions may lead to shifts in economic policies globally. **Governments might implement countermeasures** to protect domestic industries, which could further complicate international trade relationships. Investors need to stay informed about policy changes and their possible impacts on market conditions.

Conclusion

In conclusion, the potential trade threats posed by Trump hold significant sway over global markets and investment strategies. Investors are cautious yet alert, strategizing to mitigate risks and capitalize on possible opportunities. In a rapidly changing trade environment, understanding these dynamics is crucial for informed decision-making and sustained economic growth.