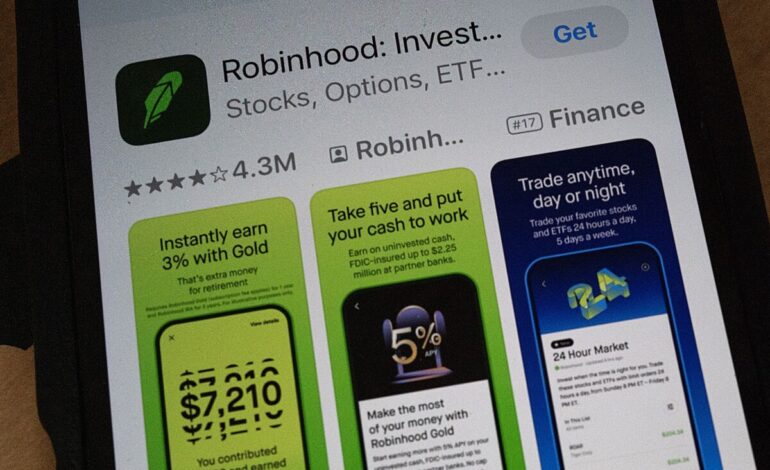

Robinhood’s Private Stock Tokens Lure Investors Amid Heightened Scrutiny

Robinhood’s innovative introduction of private stock tokens has captured the attention of investors worldwide. With the promise of democratizing stock ownership, these digital assets are both enticing and controversial. This article delves into the mechanics of stock tokens, their appeal to investors, and the scrutiny they face in the regulatory landscape.

Understanding Stock Tokens

Stock tokens are digital representations of shares in a company, allowing investors to purchase fractions of a stock. This innovation aims to broaden access to the stock market, enabling investors to diversify their portfolios without the need for substantial capital investment.

Investor Appeal and Market Impact

Robinhood’s stock tokens have piqued interest for their ability to democratize investment portfolios. By offering fractional shares, they allow users to invest in high-value stocks at lower entry points, potentially driving market engagement and expanding financial inclusion.

Regulatory Concerns

Regulation remains a significant hurdle for stock tokens. Authorities are focusing on the need for stringent oversight to prevent misuse and protect investors. The scrutiny that Robinhood faces is indicative of broader regulatory challenges that may shape the future of digital investment platforms.

Conclusion

In conclusion, Robinhood’s private stock tokens offer a tantalizing glimpse into the future of investment. Their potential to democratize and diversify investment opportunities comes with significant regulatory challenges and scrutiny. The journey of stock tokens will depend heavily on regulatory outcomes and adaptation by investors.