Investment Shift: Exploring Long-Dated Munis Overlooked by Retail Investors

As traditional retail investors overlook long-dated municipal bonds, MacKay Shields opts to explore their potential. This article delves into the strategic opportunities these bonds present, examining why key retail investors have ignored them and analyzing their long-term value within the shifting financial landscape.

The Current Market Landscape

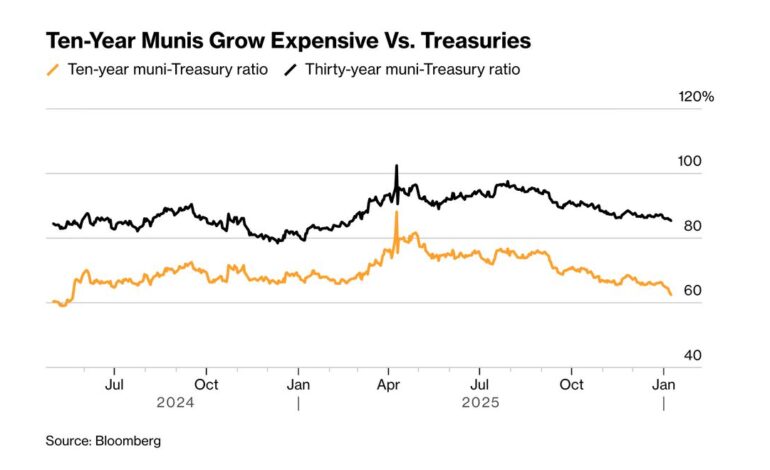

Retail investors have traditionally favored short-term municipal bonds, driven by immediate yield expectations. However, this focus has ignored long-dated alternatives, opening the door to new strategies that capitalize on their potential benefits.

Opportunities in Long-Dated Munis

Long-dated municipal bonds offer various advantages, including stability and attractive yield premiums. Investors like MacKay Shields are recognizing these prospects, prompting a shift in traditional investment approaches and consideration of previously untapped markets.

Risks and Rewards

While offering benefits, long-dated munis also come with risks such as interest rate volatility and credit risk. A balanced understanding of these factors can enhance strategic investment decisions, guiding investors in navigating and capitalizing on these market complexities.

Conclusion

In conclusion, long-dated municipal bonds offer unique opportunities for investors like MacKay Shields, who see beyond the conventional focus of retail investors. Despite their current neglect, these bonds possess potential for significant benefits and returns, underscoring the importance of understanding and leveraging emerging strategies in the bond investment market.