Awazu Advocates for Discouraging Aggressive Fundraising with FGC

The banking sector faces critical challenges with aggressive fundraising practices. In an urgent call to action, Awazu suggests introducing disincentives for aggressive capital raising tied to the Credit Guarantee Fund (FGC). This proposal aims to stabilize financial markets and protect consumers, ensuring that

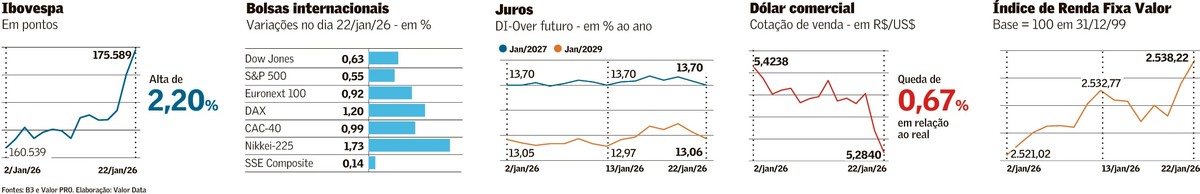

New York Stock Markets Surge Amid Favorable Data and Geopolitical Relief

In a significant turn of events, New York stock markets have shown strong upward movement, influenced by encouraging economic data and reduced geopolitical tensions. This article explores the various factors contributing to this bullish trend and examines the implications for investors and the

Dollar and Future Interest Rates Decline Amid External Relief

The recent decline in the Dollar and future interest rates is capturing attention as external economic factors provide unexpected relief. This article delves into the reasons behind these changes, exploring the interconnected nature of global markets and how this trend could impact future

Political Uncertainty and Tariffs: Their Hidden Costs

Political uncertainty and tariffs can have profound effects on the economy. This article delves into the complexities of how these factors influence market dynamics, trade relations, and economic growth. By analyzing current trends and historical data, we aim to deliver insightful perspectives on

Asian Stock Markets Surge Following Wall Street Recovery

The Asian stock markets recently closed with significant gains, mirroring a recovery seen on Wall Street. This positive movement highlights the interconnectedness of global financial markets and underscores how ripple effects from one region can impact others. This article delves into the factors

European Ammunition Group’s Stock Market Debut Sparks Investor Excitement

Shares in a leading European ammunition company experienced a significant surge during its debut on the stock market. This article will explore the factors contributing to this success, the company’s market strategy, and the broader implications for the European defense sector. Investors and

Optimizing Financial Leverage: Strategic Insights for Investors

This article delves into strategies for optimizing leverage in investment portfolios. By understanding the nuances of financial leverage, investors can enhance returns while mitigating associated risks. We’ll explore how to balance leverage use, strategic implementation, and risk management for optimal investment outcomes. Understanding

LPL Financial and Wealth.com: Enhancing Estate Planning with Strategic Partnership

The partnership between LPL Financial and Wealth.com marks a significant milestone in the financial and estate planning sectors. This collaboration aims to streamline and enhance estate planning services by leveraging technology and expertise, thus providing clients with more comprehensive and effective solutions. In

Unlocking the Potential of High-Yield Savings Accounts: Today’s Top Rates

In today’s financial landscape, high-yield savings accounts are an attractive option for individuals looking to grow their wealth with minimal risk. This article delves into the current landscape of high-yield savings rates, providing insights and strategies to help you make the most of

CD Rates for January 23, 2026: Maximizing Your Savings with APYs from 4.10% to 4.78%

As of January 23, 2026, certificate of deposit (CD) rates are reaching new highs, with annual percentage yields (APYs) ranging from 4.10% to 4.78%. In this article, we delve into the factors influencing these rates, helping you navigate the landscape of CD investing