5 Insights to Consider Before the Stock Market Opens on January 5, 2026

As we approach January 5, 2026, investors are keen to uncover crucial insights impacting the stock market on this pivotal day. This article explores five key elements that market participants need to be aware of before trading commences, providing a strategic advantage to

Fed’s Kashkari Anticipates Interest Rates Approaching Neutral Levels

This article examines Neel Kashkari’s recent insights on the Federal Reserve’s monetary policy. Kashkari suggests that interest rates are nearing neutral levels, emphasizing the critical role that data will play in shaping future policy decisions. These perspectives offer a window into the Federal

Understanding the Stability in Mortgage Rates: What January 5, 2026 Means for Homebuyers

On January 5, 2026, mortgage rates held steady with 30-year fixed rates unmoved at 6.20%. This article delves into the factors affecting this stability, market trends, and what this means for prospective homeowners. Discover insights on how these rates impact buying power and

Facing Financial Stress: An Expert-Recommended Move

When it comes to financial management, taking the first step can often be the most stressful, even for experts. This article delves into why initiating these financial strategies is crucial, the hurdles involved, and how seasoned financial planners incorporate them into a successful

Financial Sector Backs Central Bank Amidst Political Pressure in Banco Master Case

In the wake of political pressures on the Brazilian Central Bank regarding the Banco Master incident, the financial sector stands united in its defense of regulatory autonomy. This article delves into the reasons behind this support and the implications for the broader financial

Amara’s Strategic Move: Delaying Coupon for Recapitalization

Amara, a leading player in the renewable energy sector, has recently decided to delay its coupon payment as part of a broader recapitalization strategy. This move raises questions about its financial health and strategic objectives. This article explores the implications of Amara’s decision

Economic Unrest: Impact of Trump and Petro’s Conflict on Colombian Assets

Colombian assets have experienced a significant drop amid escalating tensions between Donald Trump and Colombian President Gustavo Petro. This article delves into the roots of these tensions, the market’s reaction, and potential future implications for Colombia’s economy and global relations. Roots of the

US Stocks Climb Amidst Venezuela Tensions: Tech and Energy Sectors Shine

In a surprising turn of events, US stocks saw an upward trend despite global concerns over Venezuela’s geopolitical tensions. The muted spillover effect allowed the tech and energy sectors to gain momentum, reassuring investors. This article delves into the reasons behind this market

Chevron and Oil Stocks Surge Following Trump’s Promise to Revive Venezuelan Oil Sector

The recent promise by former President Trump to rejuvenate the Venezuelan oil industry has led to a significant rise in Chevron and other oil stocks. This article explores the ramifications of this promise, examining market reactions, potential geopolitical impacts, and the future of

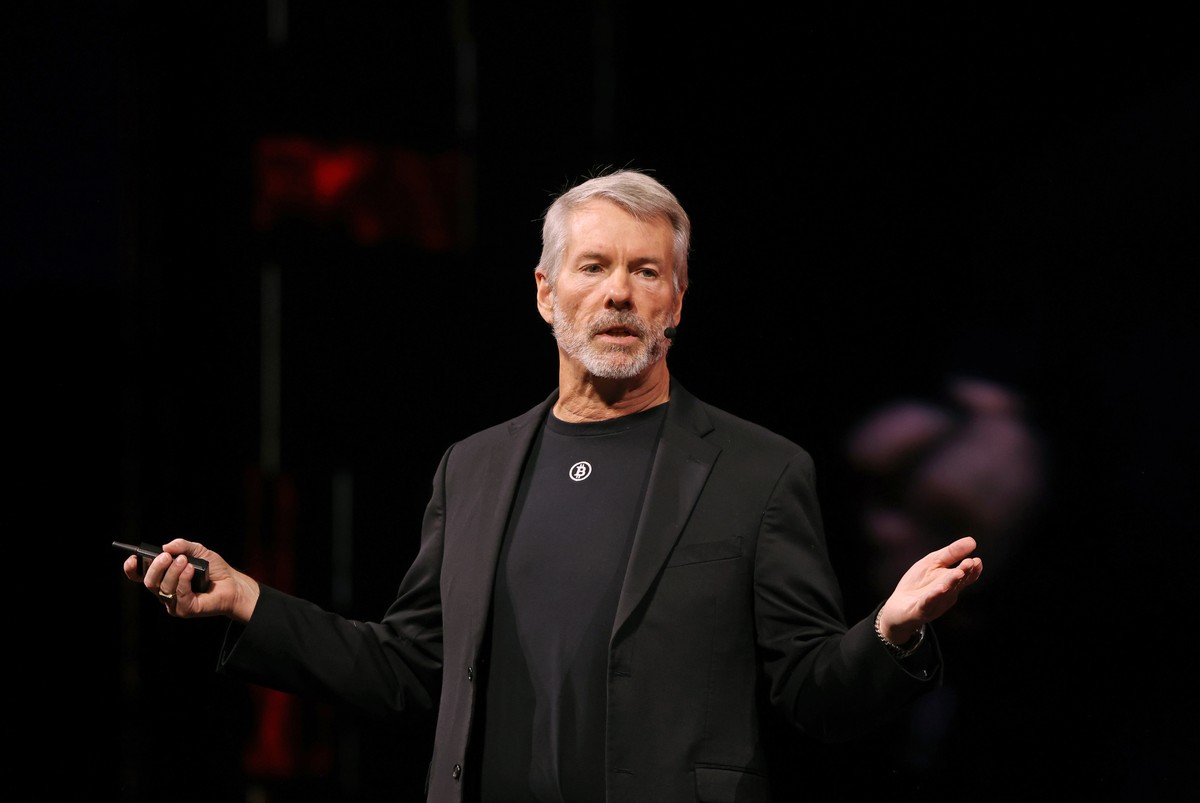

Unrealized Loss of $17.4 Billion for Strategy in Q4 Due to Bitcoin Decline

In Q4, Strategy reported an unrealized loss of $17.4 billion as Bitcoin prices plummeted. This article delves into the financial impact this had on the company, explores the broader implications for cryptocurrency investments, and examines potential strategies for recovery. The Context of Strategy’s