Key Changes to Tax Filings for Californians in 2023

As Californians gear up for tax season, navigating the latest updates can be crucial for accurate and beneficial filings. This article explores the significant changes to tax laws and regulations for California residents, providing insights to maximize refunds and stay compliant.

Updates to State Tax Deductions and Credits

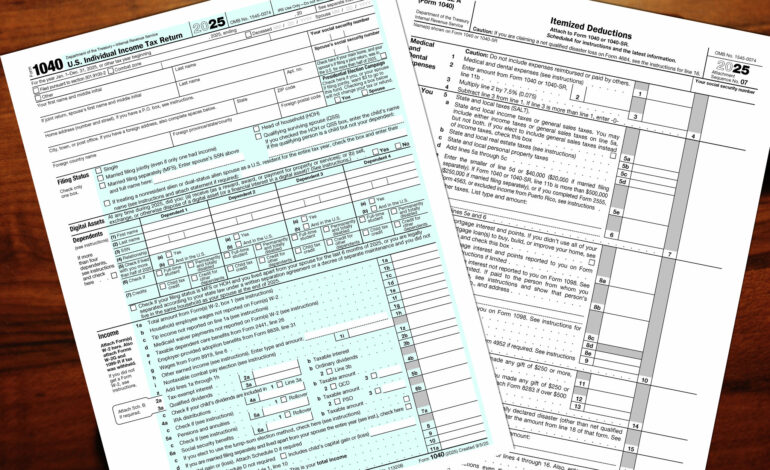

California tax filers will notice several updates in state deductions and credits this year. **Key additions include adjustments to itemized deductions and potential new credits** for certain taxpayers, aimed at alleviating financial burdens caused by recent economic shifts.

Impacts of Federal Tax Changes

The federal tax landscape has also undergone changes that may **affect Californians directly**. Understanding how modifications to IRS regulations interact with state tax obligations can help in planning effectively for filings and refunds.

Filing Deadlines and Extensions

This year brings modified filing deadlines for California residents, with **extended dates offering additional time** to prepare. Awareness of these changes ensures compliance and avoids penalties associated with late submissions.

Conclusion

In summary, staying informed about changes to tax laws is essential for Californians. By understanding adjustments in deductions, credits, and filing deadlines, taxpayers can optimize their returns and avoid unnecessary complications. Ensuring accurate and timely submissions will aid in maximizing refunds and maintaining compliance with state tax requirements.