PicPay Sets Price Range for IPO, Potential Valuation of Up to $2.6 Billion

PicPay, a leading digital payments platform in Brazil, has set the price range for its upcoming IPO, signaling a potential market valuation of up to $2.6 billion. This article explores the strategic decisions leading to this milestone, the expected market impact, and the broader context of Brazil’s fintech landscape.

Understanding PicPay’s Valuation

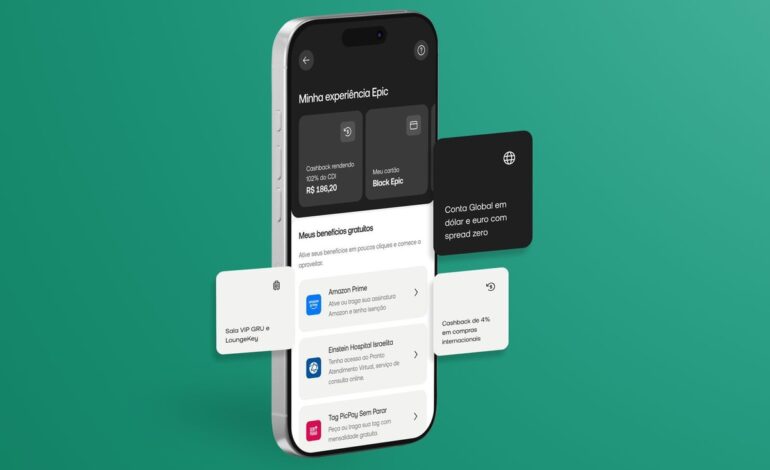

PicPay, as one of Brazil’s foremost digital payment platforms, has carved a substantial niche by offering accessible and diverse financial services. The forthcoming IPO suggests a valuation potentially reaching $2.6 billion, reflecting its robust business model and growth prospects. This chapter delves into the financial metrics and market factors contributing to this valuation.

Significance of the IPO

The decision to go public marks a pivotal moment for PicPay, opening avenues for capital infusion and increased market presence. Going public is expected to expand its operational capabilities and enhance service offerings. By analyzing PicPay’s strategic objectives, we highlight how this IPO is poised to influence both the company and the fintech industry in Brazil.

Impact on Brazil’s Fintech Sector

PicPay’s IPO is more than just a corporate milestone; it represents a wider movement within Brazil’s growing fintech sector. This chapter examines how PicPay’s market debut could set a precedent for other fintech companies in the region, inspiring innovation and encouraging investment in digital financial services.

Conclusion

PicPay’s IPO represents a significant stride in its growth journey, potentially valuing the company at up to $2.6 billion. This process not only underscores PicPay’s success but also signals a transformative period for Brazil’s fintech sector. By paving the way for future innovations, PicPay’s move could catalyze further development within the industry.