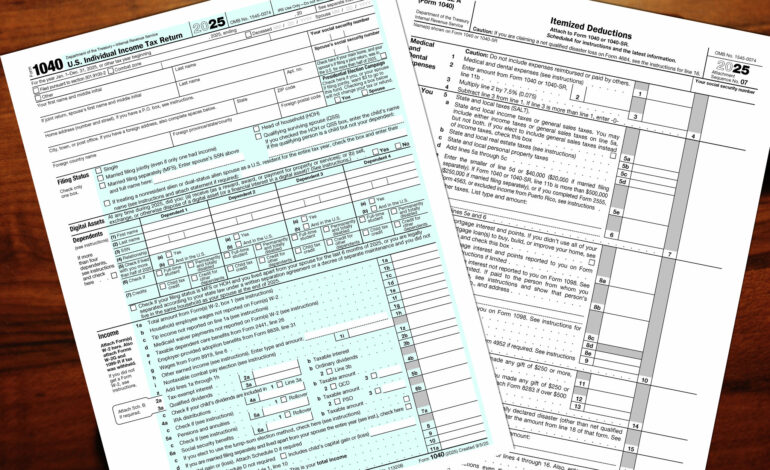

Filing Taxes in 2026: A Guide for Cost-Conscious Individuals

In 2026, navigating the tax filing process can be daunting, especially for those looking to minimize costs. Fortunately, several free options are available for filing taxes. In this article, we delve into the resources and steps necessary to file your taxes for free, ensuring you understand the choices to make the process as smooth and cost-effective as possible.

Understanding Free Tax Filing Services

Free tax filing services are avenues that allow eligible filers to submit their tax returns at no cost. Many are provided through partnerships with the IRS and reputable tax preparation companies. It’s essential to know the eligibility criteria and features of these services to determine which is best for you.

Eligibility Criteria for Free Filing

To qualify for free tax filing, you must often meet specific income requirements or choose particular forms. For instance, individuals earning below a certain income threshold or filing simple tax returns can access these services without fees. Understanding these criteria will help you avoid unexpected expenses during the filing process.

Step-by-Step Guide to Filing Your Taxes for Free

Here’s a simple guide to filing your taxes for free:

- Research: Start by researching eligible free filing programs that fit your tax situation.

- Gather Documents: Collect all necessary tax documents, such as W-2s and 1099s, before beginning your online filing.

- Select a Service: Choose a free filing service that aligns with your eligibility and offers user-friendly navigation.

- Complete the Form: Input your information carefully, ensuring all fields are completed accurately.

- Submit: Ensure you file the tax return electronically to meet deadlines and receive confirmations quickly.

Additional Tips for Cost-Conscious Filers

Being mindful of potential tax credits and deductions can further reduce your payment obligations. Keep abreast of any changes in tax laws that might impact your filing status. Free resources, such as community tax aid centers, can also provide additional support if needed.

Conclusion

By understanding and utilizing the free tax filing services available in 2026, you can avoid unnecessary expenses. Adhering to eligibility requirements and following a methodical filing process ensures a hassle-free experience. Stay informed and organized, and you can complete your tax filings efficiently without incurring costs.