US Stock Market Surge as Trump Revisits Federal Reserve Decisions

In a dramatic shift, US futures and the dollar have experienced a surge following former President Trump’s recent remarks revisiting previous Federal Reserve policies. This article delves into the implications of these statements on the global financial markets, examining shifts in investor sentiment and potential long-term economic impacts.

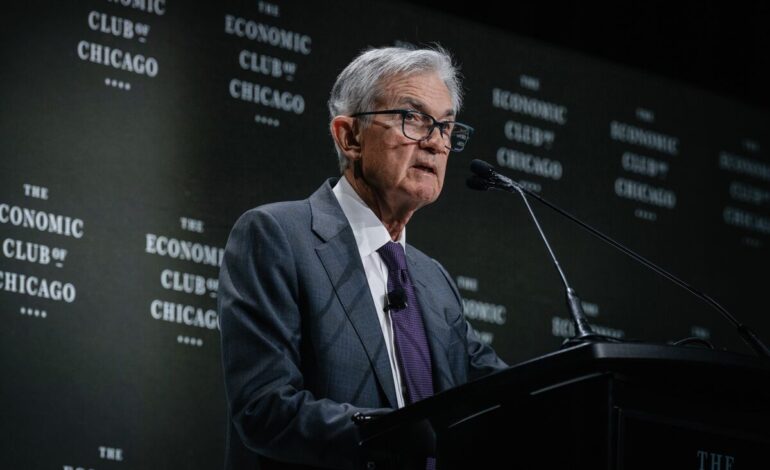

Trump’s Fed Remarks: A New Market Dynamic

Former President Donald Trump’s **backtrack on previous Federal Reserve decisions** has ignited significant movements in financial markets. His comments on potential monetary policy changes have **led to a rise in US stock market futures**, influencing investor behavior and altering market trends. This chapter explores the nuances of Trump’s statements and their immediate effects.

Investor Sentiment: Riding the Wave of Change

As the markets react to Trump’s unexpected discourse on the Federal Reserve, **investors are recalibrating their strategies**. The shift has not only propelled US futures and the dollar but also **injected new optimism into market sentiments**. This section assesses investor responses and the psychological drivers behind the latest market activities.

Long-term Economic Implications

The ripple effects of Trump’s Fed-related discourse are poised to **alter economic forecasts**, with potential adjustments in interest rates and fiscal policies on the horizon. A comprehensive analysis reveals how markets might stabilize and what long-term adjustments could mean for the **global financial landscape**.

Conclusão

In summary, Trump’s recent Federal Reserve remarks have generated significant market movement, boosting US futures and the dollar. This development has invigorated investor sentiment and signals potential long-term economic shifts. How these changes will ultimately shape the financial landscape will depend on future policy directions and global economic interactions.