The Uncertainty of Big Tech: From Stock Market Stability to Major Unpredictability

Once considered a reliable investment, Big Tech has now become a major question mark for investors. This article explores the factors contributing to this shift, including regulatory impacts, market dynamics, and the evolving technology landscape. We delve into why Big Tech’s once stable position in stock markets has turned into uncertainty.

The Rise of Big Tech as Market Stabilizers

Big Tech giants have long been seen as bastions of reliability. With their robust growth and influence, companies like Apple, Google, and Amazon provided market stability. We explore how their dominance has shaped financial markets, offering investors a safe haven during volatile times.

Regulatory Challenges and Market Dynamics

Government scrutiny and regulatory challenges have started to erode the perceived stability of Big Tech. Antitrust lawsuits and privacy concerns are becoming significant issues. This chapter examines how these factors are impacting Big Tech’s stock prices and investor confidence.

Technological Innovations and Competitive Pressure

With rapid technological advancements, Big Tech faces increased competition. New entrants and innovations disrupt traditional business models, making it hard for investors to predict future trends. We discuss the role of AI, blockchain, and other emerging technologies in reshaping the competitive landscape.

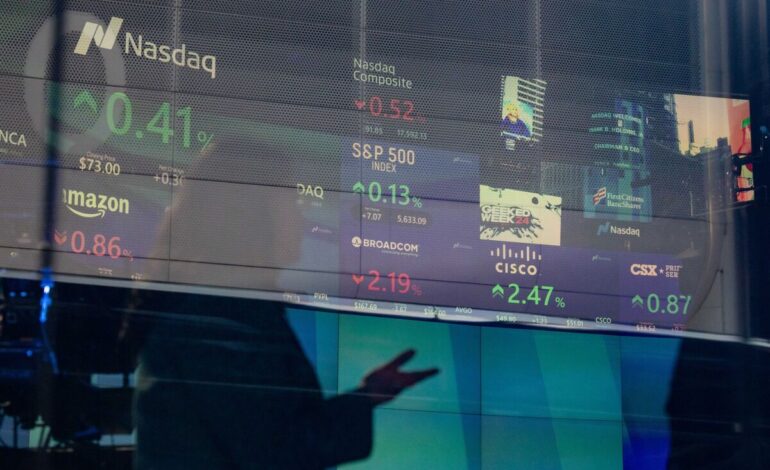

Investor Reactions and Stock Market Sensitivity

As Big Tech’s reliability is questioned, investor reactions are more sensitive than ever. Market volatility has increased, with investors responding swiftly to earnings reports and news announcements. We analyze investor behavior and its implications for future Big Tech investments.

Conclusion

The transition from market stability to uncertainty in Big Tech illustrates shifting dynamics influenced by regulation, competition, and innovation. Understanding these elements is crucial for investors amid unpredictable markets. This evolution suggests adjusting investment strategies to accommodate potential risks and capitalize on unfolding opportunities.