The Crucial Journey to Your First $100,000 Investment

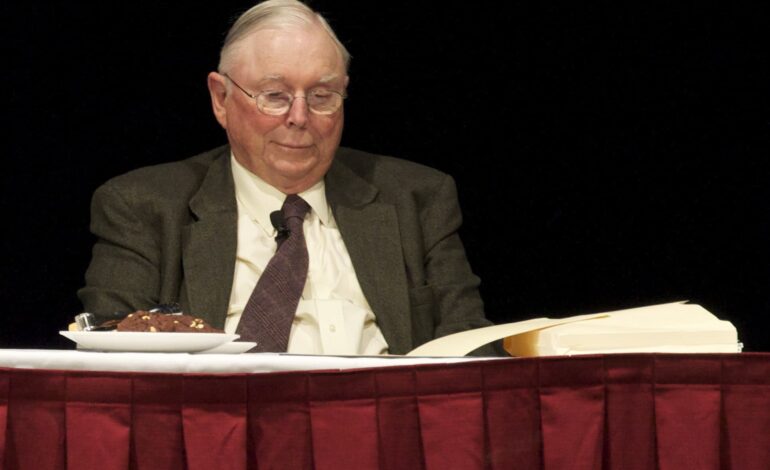

Charlie Munger, renowned for his investment acumen, famously stated, “The first $100,000 is the worst.” This article delves into Munger’s insight, exploring why reaching this financial milestone is so challenging yet critical for future investment success. We will discuss the significance of perseverance and strategic thinking in achieving this goal.

Understanding the Importance of the First $100,000

Charlie Munger’s assertion that ‘the first $100,000 is the worst’ highlights the pivotal role of this initial financial milestone. Building this foundation requires disciplined saving and astute investment decisions. It’s a formidable yet essential challenge, as it lays the groundwork for compounding growth, which is the cornerstone of wealth accumulation.

Overcoming Obstacles to Reach $100,000

Achieving the first $100,000 involves overcoming significant hurdles. Investors face temptations to spend rather than save and must combat market unpredictability and maintain focus on long-term goals. Successfully navigating these challenges demands strategic planning, budget adherence, and continuous learning about investment opportunities.

The Role of Compound Interest

Once the $100,000 mark is reached, the power of compound interest becomes an ally. This financial concept accelerates wealth accumulation, as earnings on investments generate further income. Understanding and leveraging this principle is crucial for transforming an initial $100,000 into even greater financial security and independence.

Conclusion

Reaching the first $100,000 is challenging but critical, as emphasized by Charlie Munger. With perseverance and strategic planning, this milestone paves the way for leveraging compound interest. Overcoming initial financial hurdles lays a solid foundation for a prosperous investment journey, demonstrating the value of dedication and financial acumen.