Analyzing Saylor’s $17.44 Billion Unrealized Loss in Q4: Implications and Strategies

Michael Saylor’s investment strategy has led to a massive $17.44 billion unrealized loss in the fourth quarter of 2025. This article explores the factors leading to such significant losses, the implications for Saylor’s firm, and the potential strategies that might be employed moving forward to mitigate these financial setbacks.

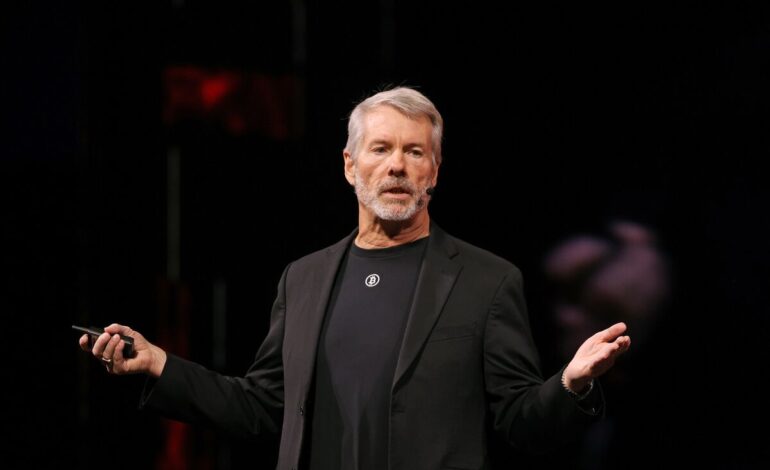

Understanding Saylor’s Investment Strategy

Michael Saylor has been a prominent figure in the investment community, known for his bold and aggressive strategies. His approach focuses heavily on cryptocurrency, particularly Bitcoin, projecting long-term value despite short-term fluctuations. This chapter delves into the rationale behind his decisions and how they align with his broader financial philosophy.

Factors Contributing to the Unrealized Loss

Saylor’s $17.44 billion unrealized loss is largely due to volatile market conditions and the inherent risks of a concentrated investment portfolio. This section provides a breakdown of external factors that contributed to the loss, including market downturns and regulatory changes, illustrating the environmental and strategic pressures faced.

Implications for Investors and Market Perception

The scale of this unrealized loss has significant implications for investor confidence and market perception of Saylor’s firm. Analyzing investor reactions, this chapter highlights how such financial outcomes impact stakeholder trust and the broader implications for investment strategy reputations.

Strategizing for Future Stability

In light of these tremendous losses, Saylor needs to revisit and potentially revamp his investment strategies. This chapter discusses possible actions, including diversification and adjusting risk assessments, to promote financial stability and rebuild investor trust moving forward.

Conclusion

Saylor’s $17.44 billion unrealized loss highlights the inherent risks of aggressive investment strategies. Through understanding market dynamics and reassessing tactics, it’s possible to navigate such financial challenges. As the situation evolves, Saylor’s ability to adapt and manage these setbacks will be crucial for future success.