Grupo Fictor Under PF Investigation After Master Acquisition Proposal

The Brazilian conglomerate Grupo Fictor recently made headlines with its bold proposal to acquire Master, yet the company now faces intense scrutiny as the Federal Police (PF) launches an investigation into its operations. This article delves deep into the unfolding situation, exploring the

Stock Market Trends: Tech Stocks Lead with Palantir’s Surge

In today’s stock market update, we explore the notable rise in tech shares, led by Palantir, and the rebound of gold and silver prices. This analysis delves into the driving factors behind these movements and what they indicate for the future of the

Anthropic’s AI Legal Tool Impacts European Tech Market Shares

Anthropic’s latest AI-powered legal tool is causing ripples across the European data services market. As shares drop for several firms in the sector, industry players are reevaluating their strategies. This article delves into the implications and explores how competitors like Pearson adapt to

Overcoming 70% Failure Rate in Enterprise AI Initiatives

As most enterprise AI projects struggle to succeed, Ravi Sawhney unveils PA.AI, a cutting-edge platform to improve the integration of human intelligence. This innovation aims to revolutionize AI governance and increase the success rates of AI initiatives across businesses. The Current State of

An In-Depth Analysis of the U.S. Immigration Policy

This article delves into the intricacies of the United States’ immigration policy, exploring recent reforms and their broader implications on both domestic and international fronts. We will examine the political, economic, and social dimensions shaping these policies and their impact on migrants and

U.S. and Iran Set to Discuss Nuclear Agreements Amidst Trump’s Warnings

In a bid to ease mounting tensions over nuclear advancements, the U.S. and Iran have agreed to engage in talks in Istanbul on February 2, 2026. This dialogue follows a stern warning from former President Donald Trump, cautioning of potential adverse outcomes if

Understanding Financial Dynamics: Insights from Valor Econômico’s Financial News

In the world of finance, staying updated with the latest trends and insights is crucial. This article delves into the financial landscape as discussed on Valor Econômico’s finance page, focusing on essential financial management principles, market trends, and investment strategies. Through detailed analysis,

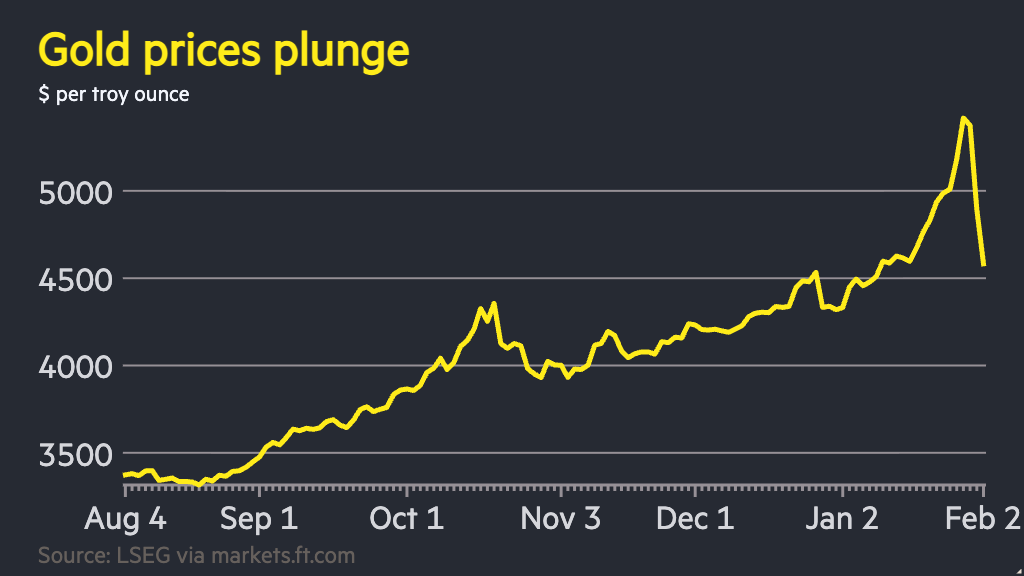

Gold and Silver Market Turbulence: Impact on Equities and Future Outlook

The recent downturn in gold and silver prices has sent ripples across global equity markets. This article delves into the factors driving this slump, the resulting effects on equities, and potential future trends in these precious metals. Understanding these dynamics is crucial for

Silicon Slopes Tech Hiring: Challenges and Future Prospects

Silicon Slopes, Utah’s tech hub, faces a lull in job growth, leading to stress among job seekers and companies. Despite difficulties, experts suggest future optimism with new strategies and growth potential, indicating a brighter path ahead. Current Hiring Challenges in Silicon Slopes The

Silicon Darwinism and the Intelligence Born from Scarcity

The concept of ‘Silicon Darwinism’ explores how scarcity in computing resources fosters genuine intelligence. By emulating natural selection, technology thrives through limitations. This article delves into the intersection of technology and evolutionary principles, revealing the ingenious developments that arise from resource constraints in